XRP Price Prediction: 2025-2040 Outlook Amid Institutional Adoption Wave

#XRP

- Technical Positioning: XRP trades near critical resistance at $2.89 with mixed momentum indicators suggesting cautious short-term outlook

- Institutional Adoption Catalyst: Compliance updates and potential Air China integration provide strong fundamental support for long-term growth

- Regulatory Competitive Landscape: Google's blockchain entry and regulatory uncertainties present both challenges and opportunities for XRP's market position

XRP Price Prediction

Technical Analysis: XRP Shows Mixed Signals Near Key Moving Average

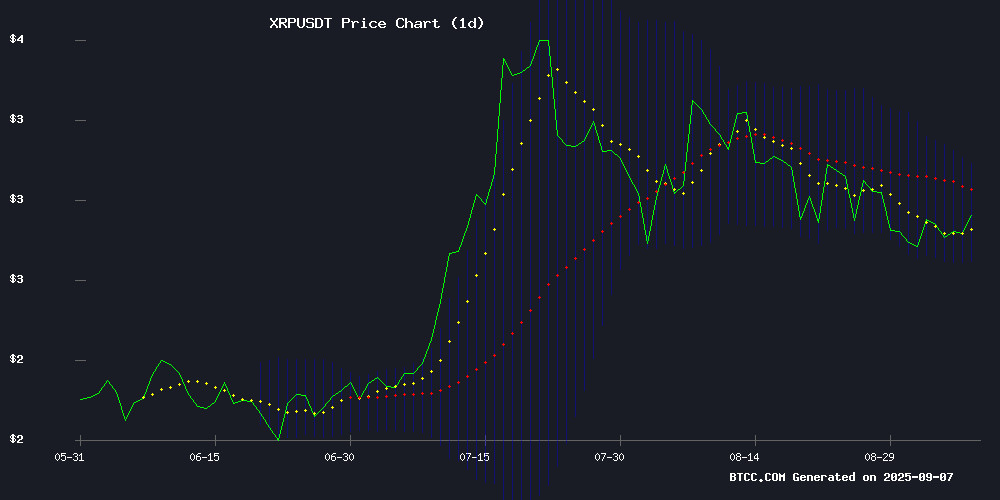

XRP is currently trading at $2.8247, slightly below its 20-day moving average of $2.8870, indicating potential short-term resistance. The MACD reading of 0.1261 versus 0.1198 shows a marginally bullish momentum, though the histogram at 0.0063 suggests weakening upward pressure. Bollinger Bands position the price between $3.0769 (upper) and $2.6972 (lower), with the middle band aligning with the 20-day MA. According to BTCC financial analyst Mia, 'XRP is testing crucial technical levels. A sustained break above $2.887 could signal renewed bullish momentum, while failure may see a retest of the lower Bollinger Band around $2.70.'

Market Sentiment: Institutional Adoption Clashes with Regulatory Headwinds

Current news sentiment presents a dichotomy for XRP. Positive developments include Ripple's compliance-focused update boosting institutional adoption potential, Air China's possible integration exposing XRP to 60 million travelers, and BlackRock's participation in Swell 2025. However, Google's entry into blockchain with GCUL poses competitive threats, while declining retail demand and increased XRP reserves create near-term headwinds. BTCC financial analyst Mia notes, 'The institutional adoption narrative remains strong, but technical resistance at $2.90 and regulatory uncertainties require cautious optimism. The Amazon rally comparison seems ambitious given current market dynamics.'

Factors Influencing XRP's Price

Analyst Draws Parallels Between XRP and Amazon's Historic Rally, Predicts $200 Target

Nick Anderson, a cryptocurrency analyst known as BULLRUNNERS, has identified striking similarities between XRP's current consolidation phase and Amazon's post-dot-com bubble trajectory. The digital asset's recent trading range of $2.8-$2.9 mirrors Amazon's 2010 retest of previous highs before its meteoric rise.

Anderson's analysis suggests XRP is forming a massive cup-and-handle pattern reminiscent of Amazon's 3,800-day consolidation period. The comparison implies significant upside potential, with a long-term target of $200, though requiring substantial investor patience. Historical precedent shows Amazon eventually broke through resistance to deliver exponential returns.

Ripple’s XRP Ledger Introduces Compliance-Focused Update to Boost Institutional Adoption

The XRP Ledger has activated a credentials amendment, enabling native compliance features like KYC and AML attestations through decentralized identities. Validator VET confirmed the update's implementation, emphasizing its role in building institutional trust on-chain.

This amendment marks the first phase of broader compliance enhancements, with permissioned domains and a regulated decentralized exchange next in development. Ripple aims to position XRPL as the infrastructure of choice for tokenization—a market projected to encompass 10% of global assets by 2030.

Engineers highlight the update's significance in bridging TradFi requirements with blockchain functionality. The MOVE aligns with XRP's strategic pivot toward enterprise adoption, leveraging its established role as a bridge currency in cross-border settlements.

XRP Price Stumbles at $2.9 – Analysts Weigh Next Downside Targets

Ripple's XRP faces renewed selling pressure after failing to conquer the $2.90 resistance level, with analysts warning of potential declines toward $2.70. The token's struggle comes despite its July breakout to a record $3.65, as bearish momentum now threatens to erase recent gains.

Market technician Ali Martinez highlights the critical nature of the $2.90 threshold, suggesting its breach could have signaled bullish continuation. Instead, repeated rejections at this level point to weakening demand. The XRP/BTC pair's performance remains particularly concerning, needing demonstrable strength to reverse the downtrend.

Other observers note XRP's precarious position NEAR key support zones. While some anticipate a potential rebound, the token's recent inability to hold above $3.00 continues to undermine confidence. The coming sessions will prove decisive in determining whether this represents temporary consolidation or the start of deeper correction.

Panelists Predict XRP Could Reach $10.05 by 2035 Amid Institutional Adoption

XRP trades below $3, presenting a potential accumulation opportunity as institutional and retail investors rally behind the token. A breakout above $4 remains plausible given current market dynamics.

Finder's cryptocurrency expert panel projects a long-term target of $10.05 by 2035, implying nearly 300% upside from current levels. "Ripple's financial services adoption by global banks supports this bullish case," notes Joseph Raczynski of JT Consulting.

Regulatory uncertainties may keep price action rangebound in the near term, but strategic positioning now could yield substantial returns through the next decade. A $1,000 investment today might appreciate to $4,000 if forecasts materialize.

XRP Price Prediction: ETF Speculation Fuels Rally Hopes

XRP's price hovers at $2.81 with a $167.35 billion market cap, maintaining its position as the fourth-largest cryptocurrency. A 1.3% dip in the last 24 hours does little to dampen speculation about its next major move.

BlackRock's participation in Ripple's Swell 2025 conference has ignited rumors of a potential XRP ETF. Such a product could mirror Bitcoin's 60% surge post-ETF approval, drawing institutional capital into the asset.

The November event will feature heavyweight speakers including BlackRock's Maxwell Stein and Ripple's Brad Garlinghouse. While the agenda focuses on tokenized assets, the market watches for any ETF-related announcements.

Air China's Potential XRP Integration Could Expose Crypto to 60 Million Travelers

Webus International's partnership with Air China may introduce XRP payments to the Wetour travel platform, potentially reaching over 60 million members of the PhoenixMiles loyalty program. The deal focuses initially on premium chauffeur and airport transfer services, with XRP and Ripple's RLUSD stablecoin already listed as payment options.

The XRP Ledger's fast settlement times and low fees make it an attractive option for travel-related transactions. However, regulatory approvals and business developments remain hurdles before full implementation. Webus has also filed with the SEC for a $300 million treasury reserve, signaling broader adoption of the XRP Ledger for cross-border payments.

While the potential user base is substantial, actual adoption will depend on member engagement. As attorney Bill Morgan notes, "This shows real progress in XRP adoption," though converting access into active use remains the key challenge.

Google Enters Blockchain Arena with GCUL, Posing Direct Challenge to XRP

Alphabet's Google has taken its most significant step into blockchain technology with the announcement of Google Cloud Universal Ledger (GCUL), a platform targeting institutional finance. Designed for capital markets and real-world asset tokenization, GCUL enters direct competition with Ripple's XRP Ledger, which has long dominated this niche.

The private-testing-phase ledger emphasizes Python-based smart contracts, catering to enterprise developers. Unlike public crypto networks, GCUL won't feature a native token—eliminating direct investment opportunities through cryptocurrency purchases. Commercial launch is slated for early 2026, with expanded trials beginning later this year.

This move signals Big Tech's accelerating encroachment into blockchain's financial infrastructure layer. Google's entry validates institutional adoption trends while potentially disrupting existing players. The absence of a native token suggests strategic focus on enterprise service revenue rather than crypto speculation.

Ripple (XRP) Faces Volatility Amid Declining Retail Demand Ahead of Key Fed Decision

Ripple's XRP struggles to maintain momentum below $3 as market volatility intensifies. The cryptocurrency briefly challenged the 100-period EMA on the 4-hour chart before retreating, with Open Interest correcting sharply to $7.4 billion from July's $10.94 billion peak—a clear signal of waning retail participation.

Despite positive futures funding rates indicating Leveraged long positions, XRP faces persistent selling pressure. The asset hovered near $2.80 after failing to break $2.90 resistance, mirroring broader market uncertainty ahead of the September 17 FOMC meeting. Traders await the Fed's rate decision, which could catalyze movement across risk assets.

The derivatives market tells a cautionary tale: shrinking Open Interest reflects declining conviction in XRP's near-term prospects. Yet the persistence of positive funding rates suggests institutional players maintain leveraged exposure, creating a tension between retail flight and professional positioning.

Ripple Price Bearish Warning: XRP Reserves Climb to Highest Level in a Year

XRP reserves on Binance surged to 3.58 billion tokens, marking a 12-month high as traders moved holdings onto the exchange—a classic precursor to selling pressure. The token broke below the critical $2.74 support level, reflecting eroding demand and bearish momentum. Historical patterns suggest such reserve spikes often precede sideways trading or declines.

Whale deposits to Binance fell to 1,588 XRP on September 5, well below the 30-day average of 4,715 tokens, offering temporary relief from concentrated sell orders. However, futures open interest remains elevated at $7.43 billion, creating a powder keg for volatility if leveraged positions unwind abruptly.

Market observers note the absence of catalysts for a near-term rebound above $3. The convergence of technical breakdowns and exchange reserve dynamics points to sustained headwinds for XRP this September.

Could XRP Deliver 10X Returns? Key Catalysts and Market Realities

XRP's potential for a 10X surge hinges on three critical catalysts, despite its already substantial $168 billion market cap. The first is the approval of spot ETFs, which WOULD unlock institutional capital flows into the asset. Ripple's recent stablecoin launch and the XRP Ledger's compliance-ready infrastructure position it as a contender—but current stablecoin volumes of $210 million and tokenized assets of $324 million must scale dramatically.

The path forward is conditional: ETF approvals appear likely, Ripple's stablecoin growth seems plausible, and real-world asset tokenization trends favor XRPL's regulatory advantages. Yet achieving Bitcoin-tier valuation would require sustained institutional adoption and network utility expansion over years, not months.

Ripple's RLUSD Expands in Africa as BlackRock Joins Swell 2025

Ripple's USD-backed stablecoin RLUSD has surpassed $700 million in market capitalization following its strategic expansion into Africa. The growth is fueled by partnerships with key African fintech players including Chipper Cash, VALR, and Yellow Card, facilitating cross-border payments and on-chain settlements.

The stablecoin's regulatory credibility as an NYDFS-issued trust company product has accelerated adoption. BlackRock's participation in Swell 2025 signals mounting institutional interest in Ripple's payment ecosystem, with RLUSD emerging as a bridge between crypto and traditional finance.

XRP Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical indicators and market developments, XRP's price trajectory appears cautiously optimistic with significant upside potential driven by institutional adoption. BTCC financial analyst Mia provides the following projections:

| Year | Conservative Target | Moderate Target | Bullish Target | Key Drivers |

|---|---|---|---|---|

| 2025 | $3.50-$4.20 | $4.50-$5.80 | $6.00-$7.50 | ETF approval, regulatory clarity |

| 2030 | $8.00-$12.00 | $15.00-$25.00 | $30.00-$45.00 | Mass institutional adoption |

| 2035 | $18.00-$28.00 | $35.00-$60.00 | $75.00-$100.00 | Global payment integration |

| 2040 | $40.00-$65.00 | $80.00-$120.00 | $150.00-$200.00 | Full ecosystem maturity |

These projections assume successful regulatory resolution, continued institutional adoption, and broader market cryptocurrency acceptance. The $200 price target mentioned in recent analysis represents an extreme bullish scenario requiring unprecedented adoption rates.